Skillful investment of capital is a necessary condition for the operation and development of a company. Indeed, this is the reason why a company can reach for more and more advanced technologies, increase its customer service capabilities or make it easier for employees to perform particular tasks. Unfortunately, such expenditures are not limited to the selection of appropriate services, products or solutions and payment thereafter. It is necessary to properly categorize and settle them each time. The basic division of expenses recognizes OPEX and CAPEX.

CAPEX expenditures for IT equipment

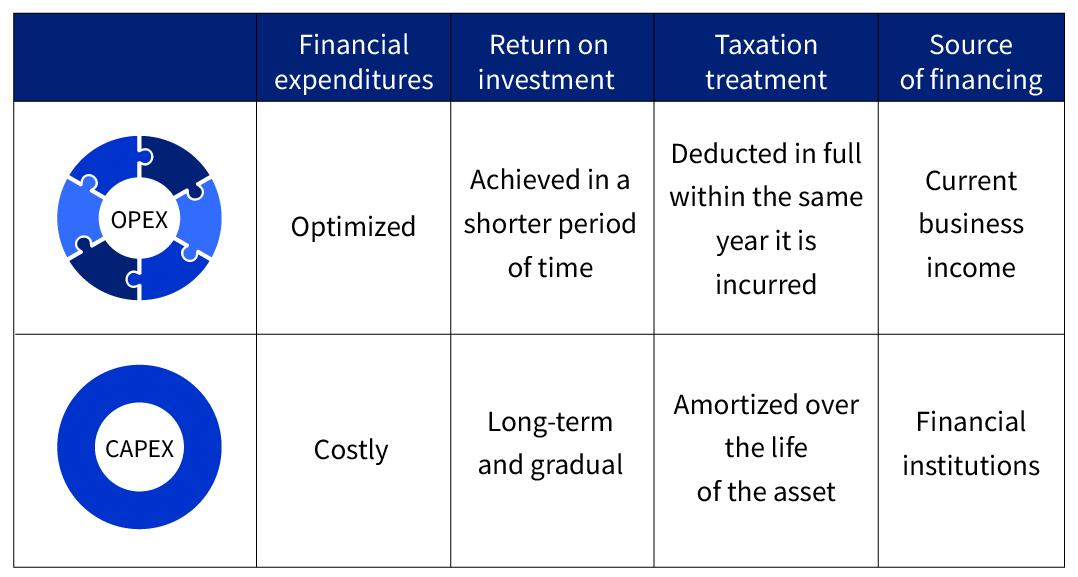

The name CAPEX is an abbreviation for capital expenditures. Expenses of this type include the implementation of new systems or investments in product development. In order for an expense to be counted as CAPEX, it is necessary to buy an item that will constitute a tangible asset of the company, acquired for the purpose of maintaining or improving its operations.

Thus, a CAPEX investment will be the purchase of equipment for the company, such as machinery to adapt space to function as a company server room or the purchase of software. These are one-off costs, which most often are large sums of money and are subject to a complicated system of tax deductions – depreciation.

What is OPEX in IT?

The term OPEX is an acronym for operating expenditures. Those are included in the costs of running a business, such as maintenance costs of the company and the product, and can take the form of leasing or fees for services such as colocation, Cloud Computing or IT outsourcing. The OPEX expenses are spread out over time, so they are less of a burden on the business than a one-time fee. In addition, the company receives a VAT invoice for each billing period, and the costs are subject to uncomplicated tax deductions.

IT infrastructure – when OPEX, when CAPEX?

While the purchase of equipment and the preparation of an in-house server room are counted as CAPEX, the use of Data Center services constitutes OPEX expenses. This is a very important difference that affects how a company’s expenses are settled.

The accounting rules for CAPEX are more complicated than for OPEX. Capital expenditure refers to the cost determined by comparing the present and previous year’s net property, plant and equipment, and then dividing the result by depreciation. In view of the fact that OPEX expenditures require only the payment of an invoice, they are easier to account for.

OPEX vs CAPEX , and IT infrastructure

When investing in its own server room, a company must purchase equipment, energy security measures and cooling systems. Moreover, it needs to involve both IT specialists to select the right solutions and accountants to account for CAPEX expenses.

Using the services of Talex S.A. can help your company avoid many problems as it receives the help of external specialists and does not have to incur the one-time high costs of adapting its own space to the needs of a server room. It gains the highest level of data security and the guarantee of continued operation of its systems, and it only has to pay invoices, which are Opex expenses.

Talex Data Center – a convenient solution in every respect

Maintenance of your own server room makes it necessary to invest in equipment, power supply, cooling systems and software, which are CAPEX expenditures. Hosting your own equipment and placing it in a Data Center or putting your system in the cloud is an OPEX expense. Cooperation with Talex S.A. will not only ensure the security of your data and systems stored in the Data Center and guarantee support from IT specialists, but will reduce the burden on your accounting department and will translate into cost stabilization.